Buying your first home is an exciting and often overwhelming experience. It involves multiple steps, from understanding your finances to finding the right property and navigating the closing process. This guide will break down each phase of the homebuying journey, offering tips and insights to help first-time buyers make informed decisions and achieve their dream of homeownership.

1. Assess Your Financial Readiness

a. Evaluate Your Savings:

Down Payment: In Canada, most lenders require a minimum down payment of 5% for homes priced under $500,000. For homes priced between $500,000 and $999,999, the minimum down payment is 5% on the first $500,000 and 10% on the portion above $500,000. For homes priced at $1 million or more, a 20% down payment is required. Saving for a substantial down payment can reduce your mortgage and monthly payments.

Closing Costs: Budget for 1.5% to 4% of the purchase price for closing costs, which include land transfer taxes, legal fees, home inspection fees, and title insurance. In some provinces, first-time homebuyers may be eligible for rebates on land transfer taxes.

Emergency Fund: Maintain an emergency fund to cover unexpected expenses like repairs, job loss, or medical emergencies. Ideally, this fund should cover three to six months of living expenses.

b. Check Your Credit Score:

A higher credit score can qualify you for better mortgage rates. Obtain a free credit report from agencies like Equifax and TransUnion. Correct any errors and work on improving your score by paying down debt and making timely payments. Aim for a score of at least 680 for conventional loans, though higher scores will yield better terms.

c. Determine Your Budget:

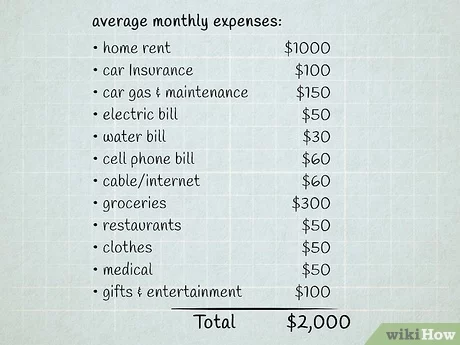

Use an online mortgage calculator to estimate how much you can afford based on your income, debt, and savings. Aim for a monthly mortgage payment (including property taxes and insurance) that doesn't exceed 32% of your gross monthly income. Factor in additional costs like utilities, maintenance, and condominium fees if applicable.

2. Get Pre-Approved for a Mortgage

a. Choose the Right Lender:

Research and compare lenders, including banks, credit unions, and mortgage brokers. Look for competitive rates, fees, and customer service reviews. Consider getting quotes from at least three lenders to find the best deal.

b. Gather Documentation:

Lenders will require proof of income (pay stubs, T4 slips, tax returns), employment verification, bank statements, and identification. Having these documents ready can streamline the pre-approval process. Organize your paperwork in advance to avoid delays.

c. Understand Loan Options:

Fixed-Rate vs. Variable-Rate Mortgages: Fixed-rate loans offer stable payments, while variable-rate mortgages (VRMs) have rates that can change over time. Fixed-rate mortgages are generally safer for first-time buyers due to their predictability.

CMHC-Insured Loans: If your down payment is less than 20%, you will need mortgage default insurance through the Canada Mortgage and Housing Corporation (CMHC) or a private insurer. This insurance protects the lender in case of default but adds to your monthly payments.

3. Find a Real Estate Agent

a. Seek Recommendations:

Ask friends, family, and colleagues for agent referrals. Look for agents with experience in your desired area and positive client reviews. A good agent will have local market knowledge and a proven track record.

b. Interview Multiple Agents:

Meet with several agents to discuss your needs, their experience, and their approach to helping buyers. Choose someone you feel comfortable with and who understands your goals. Don’t hesitate to ask for references.

c. Understand the Agent's Role:

A buyer's agent will help you find properties, negotiate offers, and navigate the closing process. Their commission is typically paid by the seller, so their services are free for buyers. Ensure your agent is committed to representing your best interests.

4. Start House Hunting

a. Define Your Must-Haves:

Make a list of essential features, such as the number of bedrooms, bathrooms, location, and amenities. Be prepared to compromise on some items. Prioritize your needs versus wants to stay focused.

b. Research Neighborhoods:

Visit potential neighborhoods at different times of day to assess noise levels, traffic, and community vibe. Consider factors like school districts, proximity to work, and local amenities. Use online resources and talk to locals for insider insights.

c. Attend Open Houses:

Open houses provide an opportunity to see properties in person, ask questions, and get a feel for the market. Take notes and photos to remember key details. Use these visits to narrow down your choices.

5. Make an Offer

a. Understand Market Conditions:

In a seller's market, you may need to act quickly and offer above asking price. In a buyer's market, you have more room for negotiation. Your agent can provide market analysis to guide your offer.

b. Draft a Strong Offer:

Your agent will help you craft an offer letter that includes the price, contingencies (such as inspection and financing), and a closing date. Be prepared for counteroffers and negotiations. A personal letter to the seller can sometimes make a difference.

c. Include an Earnest Money Deposit:

This deposit (typically 1% to 3% of the purchase price) shows the seller you're serious. It will be applied to your down payment or closing costs if the deal goes through. Ensure the deposit is held in an escrow account for security.

6. Navigate the Closing Process

a. Conduct a Home Inspection:

Hire a professional inspector to evaluate the property's condition. Use the inspection report to negotiate repairs or price adjustments with the seller. This step is crucial to avoid costly surprises later.

b. Finalize Your Loan:

Submit all required documents to your lender and lock in your interest rate. Review the loan estimate and closing disclosure for accuracy. Communicate promptly with your lender to keep the process on track.

c. Attend the Closing:

At the closing meeting, you'll sign the final paperwork, pay closing costs, and receive the keys to your new home. Review all documents carefully and ask questions if needed. Make sure to understand all terms before signing.