1. Check Your Credit Score:

Before applying, check your credit score to ensure it's in good shape. A higher credit score can help you secure a better interest rate.

2. Gather Financial Documents

Lenders will require various documents, including:

Proof of income (pay stubs, tax returns, and employment letters)

Bank statements

Proof of assets (investments, savings)

Personal identification (driver’s license, passport)

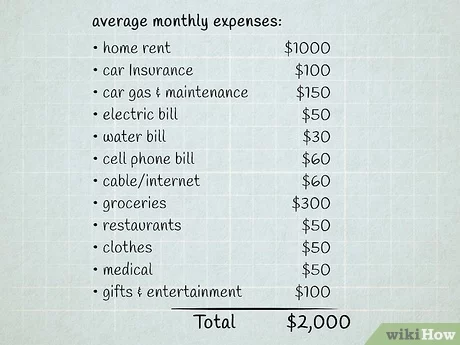

3. Calculate Your Budget

Determine how much you can afford to spend on a home. Consider your monthly income, expenses, and the amount of down payment you can make.

4. Choose a Lender

Research different lenders, such as banks, credit unions, and mortgage brokers. Compare their rates, terms, and customer reviews.

5. Apply For Pre-Approval

Submit your application along with the gathered financial documents to your chosen lender. The lender will review your financial situation and determine how much they are willing to lend you.

6. Review the Pre-Approval Letter

If approved, you will receive a pre-approval letter stating the maximum loan amount you qualify for, the interest rate, and the terms. This letter is typically valid for 60-90 days.

7. Shop for a Home

With your pre-approval letter in hand, you can start house hunting with a clear understanding of your budget.

8. Maintain Financial Stability

Avoid making significant financial changes (like taking on new debt) during the pre-approval period, as it could affect your final mortgage approval.

Comments:

Post Your Comment: